It has been some time since I last reported on the performance of companies that buy back their own equity shares. With a number of companies sitting on large amounts of cash and announcing share buybacks, including Berkshire Hathaway (BRK.A), one way to track the performance of companies buying back shares is to review the performance of the PowerShares Buyback Achievers Portfolio (PKW). The PowerShares Buyback Achievers Portfolio will normally invest at least 90% of its total assets in common stocks that comprise the Share BuyBack Achievers™ Index.

The PowerShares Buyback Achievers Portfolio is based on the Share BuyBack Achievers™ Index. To become eligible for inclusion in the Index, a company must be incorporated in the U.S., trade on a U.S. exchange and must have repurchased at least 5% or more of its outstanding shares for the trailing 12 months.The Share Buyback Achievers™ Index is a trademark of Mergent® and currently consists of 142 companies.

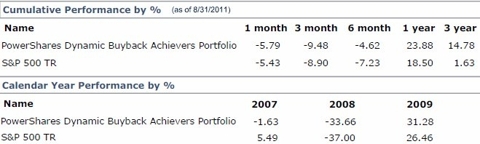

As the below chart and table detail (click to enlarge), the Buyback Portfolio (PKW) has a recent history of outperforming the broader market S&P 500 Index. Over the last two years ending 9/30/2011, PKW has generated a return of 21.87% versus the broader market S&P 500 Index return of 7.03%.

The PowerShares Buyback Achievers Portfolio is based on the Share BuyBack Achievers™ Index. To become eligible for inclusion in the Index, a company must be incorporated in the U.S., trade on a U.S. exchange and must have repurchased at least 5% or more of its outstanding shares for the trailing 12 months.The Share Buyback Achievers™ Index is a trademark of Mergent® and currently consists of 142 companies.

As the below chart and table detail (click to enlarge), the Buyback Portfolio (PKW) has a recent history of outperforming the broader market S&P 500 Index. Over the last two years ending 9/30/2011, PKW has generated a return of 21.87% versus the broader market S&P 500 Index return of 7.03%.

|

|

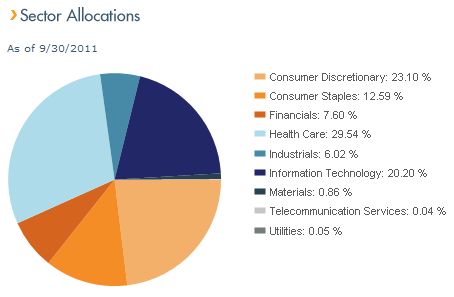

Investors should be aware of the fact that the Buyback Achievers Portfolio does contain sector concentrations. Additionally, the Portfolio does not contain any energy stocks at this time. Click to enlarge:

|

| From The Blog of HORAN Capital Advisors |

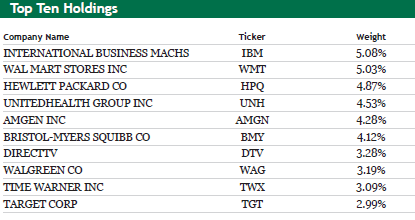

The top 10 holdings in the Index are (click to enlarge):

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.